Overview

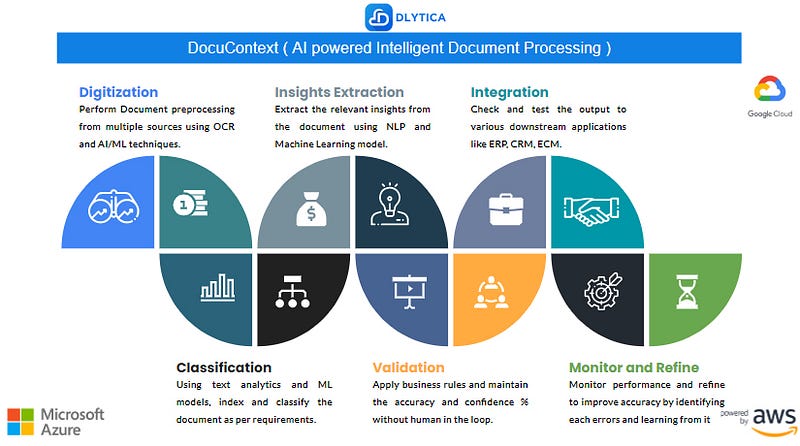

The insurance industry generates a vast amount of unstructured, semi-structured and structured documents in the form of policies, claims, and customer information. With the advancement of technology, it has become easier to process and manage this data. DocuContext ( AI Intelligent Document Processing ) is a technology that automates data entry and extraction from documents using artificial intelligence and machine learning algorithms. In this blog, we will explore the top use cases of DocuContext [Current + Future scope ] in the insurance industries.

Learn more about DocuContext here : https://www.dlytica.com/product/docucontext/

Use cases of DocuContext in Insurance:

- Claims Processing

Claims processing involves the analysis and verification of a wide range of documents, including claims forms, medical records, police reports, and more. DocuContext can help automate this process by using OCR (Optical Character Recognition) to read the documents and then using NLP (Natural Language Processing) to extract relevant data such as policy number, claim amount, and date of loss. This can help insurance companies reduce the time and cost associated with claims processing and improve the accuracy of the process. - Underwriting

Underwriting involves the assessment of risk associated with potential policyholders, which often requires analyzing a variety of documents such as policy applications, medical records, and driving records. DocuContext can automate this process by extracting relevant data from these documents, which can then be used to make more informed decisions about the risks associated with a particular policyholder. This can help insurance companies streamline the underwriting process and reduce the time it takes to decide. - Policy Administration

Policy administration involves the management of policy documents such as endorsements, renewals, and cancellations. DocuContext can help automate this process by using OCR to read the documents and then using NLP to extract relevant data. This can help insurance companies reduce manual errors and improve the accuracy of policy administration. - Fraud Detection

Fraud detection involves identifying and preventing fraudulent claims, which can be challenging due to the complex nature of the claims process. DocuContext can help by using machine learning algorithms to analyze documents such as medical bills, police reports, and witness statements, and flagging potential instances of fraud. This can help insurance companies identify fraudulent claims and reduce their losses. - Risk Assessment

Risk assessment involves evaluating the level of risk associated with a particular policy or policyholder, which often requires analyzing documents such as property appraisals, inspection reports, and credit reports. DocuContext can automate this process by extracting relevant data from these documents, which can then be used to make more informed decisions about the level of risk associated with a particular policy or policyholder. This can help insurance companies make more informed decisions when underwriting policies. - Customer Onboarding

Customer onboarding involves the process of bringing a new customer on board, which often requires analyzing a variety of documents such as ID proofs, tax forms, and employment records. DocuContext can help automate this process by extracting relevant data from these documents, which can then be used to streamline the onboarding process and reduce the time it takes to bring a new customer on board. - Document Management

Document management involves the organization and indexing of documents such as policies, claims forms, and invoices. DocuContext can help automate this process by using OCR to read the documents and then using NLP to extract relevant data, which can then be used to organize and index the documents more efficiently. This can help insurance companies reduce the time and cost associated with manual document management. - Compliance

Compliance involves ensuring that insurance companies are meeting all regulatory requirements, which often requires analyzing documents such as legal agreements, contracts, and regulatory filings. DocuContext can help automate this process by extracting relevant data from these documents, which can then be used to ensure that the insurance company is meeting all regulatory requirements. - Claims Investigation

Claims investigation involves analyzing various documents such as police reports, medical records, and witness statements to determine the validity of a claim. DocuContext can help automate this process by using machine learning algorithms to analyze the documents and flag potential instances of fraud. This can help insurance companies reduce the time and cost associated with claims investigation.

Immediate Benefits of DocuContext

- Increased Efficiency

DocuContext can automate the data entry and extraction process from documents, which can improve the speed and accuracy of processing. This can reduce the time and effort required to process claims, policies, and other documents, which can increase efficiency and productivity. - Improved Accuracy

DocuContext uses artificial intelligence and machine learning algorithms to extract data from documents. This can reduce the risk of errors associated with manual data entry and improve the accuracy of the data. - Cost Savings

DocuContext can reduce the time and effort required to process documents, which can lead to cost savings. Automation can reduce the need for manual labor, which can result in reduced labor costs. - Better Compliance

DocuContext can help insurance companies comply with regulatory requirements by automating the data entry and extraction process from compliance documents. This can reduce the risk of compliance errors and improve the efficiency of compliance management. - Enhanced Customer Experience

DocuContext can speed up the claims processing time, which can improve the customer experience. Faster claims processing times can lead to higher customer satisfaction and retention rates. - Fraud Detection

DocuContext can help identify potential cases of fraud by identifying inconsistencies in the data extracted from claim documents. This can improve the accuracy of fraud detection and reduce the risk of fraudulent claims.

In conclusion, DocuContext ( AI Intelligent Document Processing ) offers several benefits to the insurance industry. By automating data entry and extraction from documents, DocuContext can increase efficiency, improve accuracy, reduce costs, improve compliance, enhance the customer experience, and improve fraud detection. These benefits make DocuContext an essential technology for the insurance industry in the digital age.

Conclusion

In conclusion, DocuContext ( AI Intelligent Document Processing ) is a powerful tool for the insurance industry. By automating data entry and extraction from documents, DocuContext can improve accuracy, speed up processing times, and reduce errors. The top use cases of DocuContext in the insurance industry include claims processing, policy administration, underwriting, fraud detection, and compliance. As the insurance industry continues to digitize its operations, DocuContext will become an essential technology for managing the growing volume of data.

What’s next?

Want to learn more.

We have number of solutions to help you to modernize your Data Warehouse.

1. Free Data Architecture Consultation

2. Pay as you go data resources

3. Robotic Process Automation

4. Data Warehouse Solution

5. Big Data and BI

Visit our website and contact us today.

Contact us today to learn how can Dlytica help you for your next step.

Contact Us : https://www.dlytica.com/contact-us/

Official Site : https://www.dlytica.com/

Linkedin : https://www.linkedin.com/company/dlytica/