How can AI automate Insurance Industry?

How can AI automate Insurance Industry?

In this article, you will learn :

- What is Insurance Claim Process Automation?

- Why do you need Insurance Claim Process Automation?

- How can Dlytica help you to solve this?

- Benefits

- Results

What is Insurance Claim Process Automation?

Claims Processing is the backbone of the insurance industry. At this point, the insurance provider fulfils its commitment to its clients, establishes service standards, builds credibility, and meets its legal requirements. Because it encompasses multiple layers of administrative, management, and customer service responsibilities, marked by information-intensive manual tasks and challenging document formats, the claims environment is heavily dependent on process speed and accuracy to meet customer demands.

Why do you need Insurance Claim Process Automation?

1. Manual inputs:

Processing claims traditionally involves a lot of manual effort. As a result, the procedure becomes more unpredictable and error-prone. When the staff is outsourced, the situation worsens even further. Companies frequently have to rely on unreliable and unskilled workers, which results in higher costs and longer processing times.

2. Legacy Applications:

Insurance firms frequently get stuck on the legacy apps that power their essential operations. These applications occasionally lack modern functionality and struggle to work with more recent, cutting-edge alternatives

3. Disparate Input Data types:

Paper, digital documents, pictures, emails, and occasionally even the applications handling the many stages of the process are distinct from one another and are not integrated. The end effect is a glaring lack of accountability and faithfulness.

4. Data retrieval:

Data frequently disappear or become incredibly difficult to recover in the maze of software, procedures, applications, and systems. As a result, data retrieval may end up costing significantly more and taking more time.

5. Regulation and compliance:

Regulation changes may have a significant influence on processing. In fact, it’s possible that the entire procedure needs to be redesigned at times. When a business operates in several regions and locations, each with its own laws and regulations, this can become a significant disadvantage.

6. Data Silos:

Data silos are a problem in all organizations, not just those who are used to “doing business the old way,” thus they are not unique to the insurance industry. There, departments operate separately and rarely share data; this isn’t usually due to a lack of desire on their part, but rather they do not have integrations and infrastructure set up to share data cross platforms.

How can Dlytica help you to solve this?

Claims processing is one of the biggest functions within an insurance business. Depending on the type of insurance, there can be a plethora of claims that are routine and low-risk. Having a claims analyst manually approve these types of claims can result in long processing times, which could lead to customer dissatisfaction.

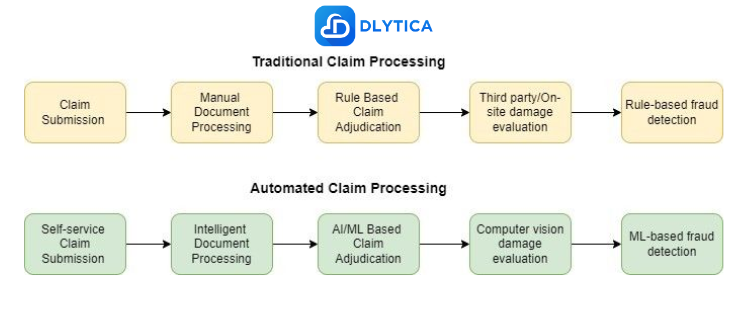

By using Robotic process Automation and AI/ML models we can completely automate the claim processing pipeline. The RPA bots helps you to extract the data from various media formats such as texts, images and videos and loads into Data lake. Multiple machine learnings models can be build to achieve some of the below complex activities in the claim processing pipeline:

- Smart claim triaging using predictive analytics: Claims triage is the process of sorting high volumes of claims by urgency. In case of catastrophic events or simply during peak season when insurers are experiencing large claim intakes, they need to quickly and confidently identify which claims need to be resolved first and by whom.

- Damage evaluation using computer vision: In typical situations, damage estimation is handled manually in a vehicle repair shop and/or by an adjuster arriving at the accident site. It takes days if not weeks to receive a report from an expert, which in turn has to be inspected by an insurance provider for mistakes or unfair payouts. Instead, the machine learning model can compare the smartphone image to its vast database of car damage pictures to determine the severity and estimate the cost of the repairs.

- Auto-adjudication: Claim adjudication refers to the process of paying or denying insurance claims by reviewing the claim’s correctness and validity. Typically done by the insurance company staff, adjudication includes the long list of checks: for errors or omissions, for the appropriate diagnosis or procedures, for the correct insurance policy, etc. Since many of these checks don’t require human intervention building Machine learning model helps you to achieve this with high accuracy

- Fraud detection : Insurers estimate that around 18 percent of all claims are fraudulent. Fake accidents and vehicle thefts along with phantom medical procedures are some of the most common types of claim fraud. Although you can create rules to make checks for well-known indicators of fraud, you will have nothing to combat newly appearing schemes or fraud patterns unnoticed by human analysts. A machine learning algorithm will analyze FNOLs(First Notice Of Loss), police reports, medical bills, forms filled by clients and insurance agents, will find correlations that may be missed, and will do this instantly, in real time. And when a claim is flagged as potentially fraudulent, depending on the probability, the payout can be automatically denied, or human agents can investigate the claim further.

The ML model can also segment the claims into particular categories and can even have a score associated with them for how likely they are to be approved. From there, the claims can be automatically approved or given to the analysts in a prioritized list to help them decide where to spend their time.

Business Architecture:

Technical Data Architecture

Benefits:

Increase in Data Accuracy: Claim automation can help to avoid errors in data entry, ensuring that the information being relied on to make decisions is accurate from the start. Accelerated transformation : Claim automation is a major component in digital transformation for insurance industry.

Major cost savings: Insurance claim automation drives rapid, significant improvement to business metrics and reduce the manual effort of agents to process the claims.

Faster claims processing: In addition to reducing manual work, claim automation helps insurers process claims faster since they are immediately notified when a specific requirement is met by the claimant.

Greater resilience : Claim processing ML models and RPA robots can ramp up quickly to match workload peaks and respond to big demand spikes.

Improved compliance : Automating claim processing pipeline results in better compliance.

Boosted productivity: Manual tasks consume a significant amount of time and energy, so staff can’t processing many claims per day. When you configure RPA bots and ML models properly for a claim processing workflow, it can increase a team’s capacity for completed work.

Better customer communication: Automation helps to trigger timely notifications to claimants about the status of their claim and any pending requirements.

Inform underwriting decisions: The frequency and value of claims can be automatically tallied and added to the customer record, so underwriting has a full picture of the evolution in the risk for each customer.

Enhanced Customer experience: When the claim is processed faster with the help of ML models and RPA bots, it reduces a customer’s effort and waiting time for claim processing. In turn, the customer gets the claim amount on time, which results in a better customer experience.

Results:

- 30–40% Improved ROI

- 60% Reduction in Manual work

- 50% Decrease in Claim processing time

- 45% Increase in Productivity

- 80% Reduction in Errors

- 65% Increase in Compliance

What’s next?

Want to learn more.

We have number of solutions like Insurance Claim Automation.

1. Free Data Architecture Consultation

2. Pay as you go data resources

3. Robotic Process Automation

Visit our website and contact us today.

Contact us today to learn how can Dlytica help you for your next step.

Contact Us : https://www.dlytica.com/contact-us/

Official Site : https://www.dlytica.com/

Linkedin : https://www.linkedin.com/company/dlytica/

By Suyogya Banepali on .

Recent Post

Globally, most banks face one of the most significant issues with non-performing assets, or NPAs. For instance, the NPA ratio in India has decrea [...]

What Is a Sovereign AI Lakehouse Platform? A sovereign AI lakehouse platform unifies data lake and data warehouse capabilities with built‑in AI t [...]

Why Enterprises Are Choosing DataNature over Cloudera, Databricks, and Snowflake? Across Canada, banks, telcos, and public-sector organizations a [...]

Empowering businesses with unified data, intelligent automation, and real-time insights. Introduction: How an AI Data Platform Drives Enterprise [...]

Introduction Artificial Intelligence (AI) is quickly changing industries, and this is most obvious in the finance and banking worlds. From fraud [...]

Introduction In today’s digital environment, data-driven technologies are reshaping how companies operate. Every day, organizations produce enorm [...]

Introduction Customer data is growing at lightning speed, but making sense of it remains a challenge. This is where AI agents in customer analyti [...]

Introduction Big Data and AI are transforming the way businesses handle massive datasets. In today’s fast-paced digital world, organizations stru [...]

Introduction The Banking and Financial Services (BFSI) industry is at the edge of a major transformation. With rising customer expectations, incr [...]

Introduction In the rapidly evolving world of technology, the development of customized Large Language Models (LLMs) is a frontier being explored [...]

Introduction: In the rapidly evolving technology landscape, Data and Artificial Intelligence (AI) are reshaping industries and revolutionizing bu [...]

Introduction: Language is the glue that connects us in this digital age. From chatbots that converse with us to virtual assistants that understan [...]

In the modern business landscape, data is the new oil, powering decisions and strategies across sectors. Dlytica Inc., with its cutting-edge data [...]

Data Analyst: A Data Analyst scrutinizes numeric data to aid companies in making informed decisions. They are often the entry point for individua [...]

Introduction Collision 2023, the largest AI event of the year, served as a vibrant hub of innovation, collaboration, and knowledge-sharing. In th [...]

Overview Intelligent Document Processing (IDP) is an Artificial Intelligence (AI)-driven technology that is rapidly transforming the way business [...]

Overview In today’s fast-paced business world, companies generate a vast amount of data, most of which is stored in paper-based or unstructured d [...]

Overview The insurance industry generates a vast amount of unstructured, semi-structured and structured documents in the form of policies, claims [...]

Overview Intelligent Document Processing (IDP) refers to the use of Artificial Intelligence (AI) technologies to automate the data extraction pro [...]

In the digital age, businesses are constantly looking for ways to streamline their operations and increase efficiency. One area that holds great [...]

Overview: Intelligent Document Processing (IDP) refers to the automated process of analyzing, extracting, and categorizing data from various type [...]

Introduction: Cloud computing is a technology that allows users to store, access, and manage data and applications over the internet. Instead of [...]

Introduction to Resource Augmentation IT resource augmentation services are a growing trend in the business world, as organizations look for ways [...]

Introduction to Data Warehouse A data warehouse is a centralized repository of structured and organized data that is used for reporting, analysis [...]

Overview: Robotic process automation (RPA) is a software technology that makes it easy to build, deploy, and manage software robots that emulate [...]

How can AI automate Insurance Industry? In this article, you will learn : What is Insurance Claim Process Automation? Claims Processing is t [...]

What is CMAP? One of the premium solution provided by Dlytica is Cloud Migration Acceleration program (CMAP).Migrate to cloud with our suppo [...]

With an Innovative team at DLytica, we work on converting your Data Strategies to Solutions. We leverage a team of skilled Data Architects, Data [...]

Who are we? Company’s tagline : Drive your business with Data Analytics and AI with DLytica Inc. With an Innovative team at DLytica, we [...]

Overview: Fraud is evolving and nowadays it looks more like organized crime with international and cross-functional teams involved. It means that [...]